The weight of oil prices

Another significant critique of the TRAIN law is aimed at its oil excise tax hike. Under the TRAIN law, excise tax on fuel will see an increase of Php 2 per liter by 2019, and Php 1.50 per liter by 2020. Currently at around Php 2.50 per liter and having been in effect since January 1, 2018, the fuel excise tax has been cited as the main cause of the country’s continuously skyrocketing inflation.

Government economic managers, however, continue to assert that TRAIN 1 is only one factor in the increase in the prices of petroleum products, and on the country’s overall inflation. Chua has stated that higher oil prices are due to external factors—particularly the US sanctions on Iran’s oil exports—which drove world crude oil prices to USD 76.33 per barrel, while Guinigundo said that TRAIN 1 caused just .07% of August 2018’s 6.7% inflation rate.

The law, however, also states that tax increases may be suspended if Intercontinental Exchange (ICE) Brent Crude oil prices—considered as the benchmark for global oil prices—reach the level of USD 80 per barrel in three months, before the next scheduled hike. According to CNN Philippines, Brent crude reached an intra-day high of USD 80.50 on May 17, 2018, before closing that day at USD 79.26 a barrel. Moreover, crude oil prices were hovering around the USD 80 range from September 21 to October 23, going as high as USD 85.38 per barrel.

Another significant critique of the TRAIN law is aimed at its oil excise tax hike. Under the TRAIN law, excise tax on fuel will see an increase of Php 2 per liter by 2019, and Php 1.50 per liter by 2020. Currently at around Php 2.50 per liter and having been in effect since January 1, 2018, the fuel excise tax has been cited as the main cause of the country’s continuously skyrocketing inflation.

Government economic managers, however, continue to assert that TRAIN 1 is only one factor in the increase in the prices of petroleum products, and on the country’s overall inflation. Chua has stated that higher oil prices are due to external factors—particularly the US sanctions on Iran’s oil exports—which drove world crude oil prices to USD 76.33 per barrel, while Guinigundo said that TRAIN 1 caused just .07% of August 2018’s 6.7% inflation rate.

The law, however, also states that tax increases may be suspended if Intercontinental Exchange (ICE) Brent Crude oil prices—considered as the benchmark for global oil prices—reach the level of USD 80 per barrel in three months, before the next scheduled hike. According to CNN Philippines, Brent crude reached an intra-day high of USD 80.50 on May 17, 2018, before closing that day at USD 79.26 a barrel. Moreover, crude oil prices were hovering around the USD 80 range from September 21 to October 23, going as high as USD 85.38 per barrel.

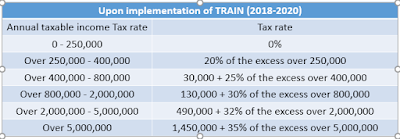

TRAIN will lower personal income tax (PIT) for all taxpayers except the richest.

The personal income tax system of TRAIN

will exempt some 83% of current taxpayers.

Lowering the personal income tax (PIT)

- A matrix is presented comparing the eight percent (8%) and graduated income tax rates with emphasis on tax base, allowed deductions, applicable business tax, required financial statements and applicability to a taxpayer’s income classification.

- The RMC reiterates who qualified MWEs are, what their tax exempt and non-exempt income items are and, how such items must be presented on BIR Form No. 1601-C (Monthly Remittance Return of Withholding Tax on Compensation).

- There is no change in the tax treatment of "de minimis" benefits. They remain exempt from income tax and fringe benefit tax. Benefits given in excess over the de minimis caps shall from part of "other benefits" subject to the P90K exclusion basket and any amount in excess of the exclusion basket shall be subject to income tax withholding on compensation.

- The first P250K of annual taxable income is exempt from income tax to balance out the removal of the personal and additional exemptions of individual taxpayers. Since these exemptions were repealed, individual taxpayers are no longer required to update their taxpayer status and submit relevant documents to the BIR.

- Individuals who are not qualified to make the 8% income tax rate election are enumerated. For qualified individuals, there are reportorial requirements that need to be complied with to signify the election of the 8% income tax rate; otherwise, the graduated income tax rates shall apply.

- Compulsory contributions by an employee to SSS, GSIS, Pag-IBIG and PhilHealth remain as exlusions from taxable compensation income.

- Tax withholding rates for individuals taxpayers engaged inbusiness or practice of profession such as doctors, consultants and contractors were provided in a matrix based on the individual's level of the gross sales/receipts.

- The RMC clarifies who are the individuals that are not qualified to avail of the substituted filing, (e.g. individuals with multiple employers in a taxable year, whether successive or concurrent, regardless of the amount of compensation) and the requirement to file for an annual personal tax return (i.e. BIR Form No. 1700 for purely compensation income earner and BIR Form No. 1701 for self-employed or mixed income earner). For qualified employees, those whose income did not exceed P250K from a lone employer and the tax due was properly withheld by such employer, the Certificates of Tax Withheld filed by the employer and duly stampled "received" by the BIR shall tantamount to the substituted filing of the annual personal tax return of the employees. The RMC further clarifies that the Certificate of Tax Withheld shall refer to the Certified List of Employees Qualified for Substituted Filing prescribed in Annex F of the RR No. 11-2018 with accompanying soft copy of the corresponding Certificate of Compensation and Tax Withheld (BIR Form No. 2316). The list shall be stamped "received" by the BIR and this shall constitute as the annual personal tax substitute. From a reading of this, it is suggested that the BIR Form No. 2316 need to required to be stamped by the BIR.

- Health card premiums paid by the employer for its employees, whether rank and file or managerial/supervisory, under a group insurance shall be included as part of “other benefits” of these employees which are subject to the P90K exclusion basket. This interpretation seems to be a departure from the existing provisions of RR No. 3-98, as amended, which provides that the cost of premiums borne by the employer for the group life insurance of his employee shall be considered as a non-taxable fringe benefit. This can also find support in the tax rulings where the BIR held that the premium payments to be borne by the employer are neither taxable fringe benefits nor subject to creditable withholding tax on compensation.

It is worth noting that the RMC No. 50-2018 merely provides a general guidance on the foregoing tax provisions. Therefore, it is advisable that it must be read in conjunction with the pertinent provisions of the TRAIN Act, the Tax Code and its amendatory regulations.

With the inquisitive public, the challenge is for the BIR to further clarify the issues/concerns raised on the changes to personal taxation brought about by the TRAIN law through straightforward issuances

No comments:

Post a Comment